A Word of Caution For the Next Gen Financial Advisor

There is a tectonic shift taking place in the Financial Advisory Industry and the average Investor will suffer as a result.

Here’s the situation: Over the next 5-10 years, 40% of licensed Advisors will retire by “selling” their books of clients to a younger generation of FAs. The retiring FAs control over 60% of the assets that are custodied by their Broker-Dealer or other Custodian. These older Advisors spent decades learning their craft, surviving their mistakes and ultimately gaining the trust of their clients. It is not unusual for a Senior FA to have over $500M in assets and earning over $1M annually.

The majority of next generation FAs that will assume responsibility for a Senior FAs lifetime of work are simply NOT READY.

Most of the wealthiest clients in these Senior books are probably close in age to Senior FA. As these clients recognize how lame the next Gen FA actually is, they will seek more qualified guidance from an Advisor that walked a path similar to their prior FA.

If you are a Next Gen FA on a large Team currently getting a percentage of business that you never earned, your best year will likely be the final year that your Senior FA is in Production. You may stay on a plateau for a bit, but the 1st time you face an unexpected market event or prolonged business downturn, your income is going to drop. Since you never bothered to master the art of prospecting and are ill prepared to use your non-existent “wisdom” to placate your clients, many will leave.

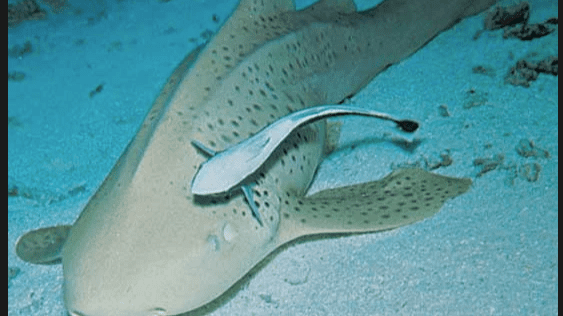

You will lack the skill to replace them and perhaps-too late, wished you had heeded this advice: If you join a Team without the ability to THRIVE on your own, you should consider changing your title from FA to Remora.

If you are wise enough to realize that the best FAs are always learning and your mission in life is to protect investors from the poseurs that think the title is all they need, the next generation of Investors will be waiting for your call.

If you are approached by a Senior FA or Team as a potential successor, DO NOT commit to anything permanent that would hinder your ability to grow independently. There are many FAs in the early part of a promising career who sign over their future thinking the pot of gold is just a few years out and end up as “the planning or tech person” who is now at the beck and call of what they hope is their ultimate benefactor.

One of the best parts of being an FA is you have total control over your future. If you are prepared to give that up-at least get it in writing.

For the small percentage of young FAs that choose to build a book from scratch and succeed, over the next 5-10 years you will have many opportunities to acquire Books from Senior FAs who realize their potential successor is not up to the task of caring for the clients in the way they have come to expect and deserve.

#FinancialAdvisory #CareerAdvice #WealthManagement #SuccessionPlanning